Bubbles Are a Feature, Not a Bug

This is what $7 trillion in productive chaos looks like

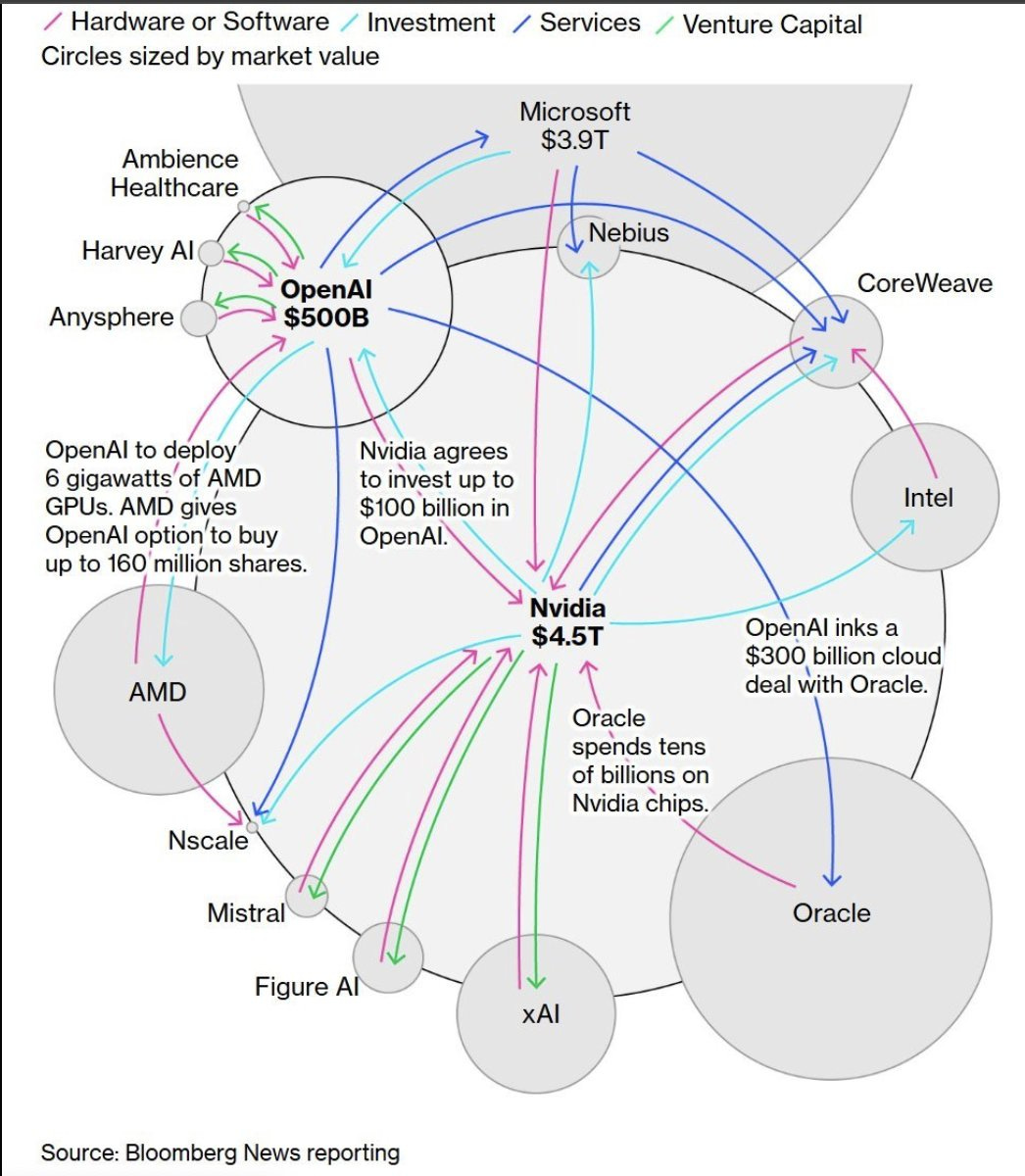

That Bloomberg chart showing the AI industrial web, Nvidia, OpenAI, AMD, Oracle, Microsoft, says more about the economy than any Fed report. It shows how capitalism funds the future: chaotically, expensively, and productively.

Planned economies try to manage capital allocation. They miss waves because they can’t price uncertainty fast enough. Market economies do the opposite. We overfund the beginning, crash, and then sort out the signal. But in the process, we build the rails for the next era. The “bubble” is the R&D tax we pay for progress. The net present value of that optionality is enormous.

In 2000, speculative money built the internet’s plumbing, fiber, routers, and early data centers. Global Crossings was a bust for its investors, but its collapse provided infinite bandwidth infrastructure, eliminating all the friction in the buildout of the modern internet. What was lost on Global Crossings was returned 100x in the FANGs. You did not care in the end if you were in both trades.

In 2025, profitable money is building cognition’s plumbing — GPUs, models, and energy. Jeff Bezos called it an industrial bubble: not a mania, but a financed build-out of future infrastructure. He’s right.

The New Flywheel

Unlike the dot-com era, this one runs on profits, not promises.

Nvidia just posted $46.7 billion in quarterly revenue, with $41 billion from data centers. Microsoft’s cloud margins hover near 40 percent. OpenAI is financing AMD and Oracle with actual cash flow. This is a closed-loop industrial feedback system — compute demand drives hardware profits, which fund more infrastructure, which creates more capacity, which drives more demand.

The first industrial revolutions were financed by government land grants, debt, and subsidies. This one is being built on private balance sheets, the most profitable companies in history, reinvesting their own cash. That’s new.

Even if prices collapse, the assets remain: chips, data centers, power lines, trained models. The internet crash of 2001 left behind the fiber that later powered Netflix and AWS. Today’s overbuild will do the same for AI.

Catch the Train

The winning investors in this bubble sequence will hop the train and find the Amazons in the noise. An interesting interview with Jensen Huang that will look prescient or insane looking back….

The part that I’m asked a lot by, CEOs that I work with about now, given all of that, what happens? What do you do? This is a common sense of things that move fast, right?

If you have a train that’s about to get faster and faster and go exponential, the only thing that you really need to do is get on it.

And once you get on it, you’ll figure everything else out along the way. And so to predict where that train’s gonna be right. And try to shoot a bullet at it. Or predict where that train’s gonna be and it’s going exponentially faster every second and go figure out what intersection to wait for it. That’s impossible. Just get on it while it’s going kind of slowly. And go exponential along the way.

Jensen Huang

Who Wins After the Bubble?

Every bubble leaves a core of survivors who own the rails. Traders like Paul Tudor Jones see a blow-off top coming. Builders like Bezos see productive overbuild. They’re both right. The question isn’t whether this is a bubble; it’s who will convert the infrastructure into dominance when it deflates.

The likely winners will control energy and compute arbitrage, matching power, location, and latency at scale. They’ll be model-agnostic, serving inference across platforms. And they’ll build vertical systems in health, defense, logistics, where AI becomes the production engine itself.

The Takeaway

In a planned economy, capital is rationed and waves are missed.

In a market economy, we overfund early, crash, and keep what’s useful.

The bubble isn’t a bug. It’s how we pre-pay for the next industrial base.

The only question is who turns that infrastructure into dominance.