Imperfect Knowledge

Might imperfect information arbitrage outperform diversification?

The biggest lesson from Crusonia Forum Brooklyn, as it applies to a Food is Health investment theme, is public markets are still in learning mode. The market has yet to price how biology and big data drive innovation and deflation in agtech, healthcare, and food. In a $3.6T US market, the investment arbitrage is hidden in plain sight.

And this is not the first time we have seen companies with an information arbitrage mispriced in public markets for decades.

The ability to act on the information arbitrage of early-stage venture capital may far outweigh the return on a Seed or A stage deal alone. If you can maintain participation rights once the optionality reveals itself, you can leverage the information. The most obvious step is to make an outsized investment in the option. You can also make long/short allocations to the broader market. In terms of portfolio theory, the combination of investment options lets you increase alpha while reducing beta. If you have access to a venture fund that allows asymmetric late-stage allocation (in contrast to a closed-end fund), you can apply private capital at the right place and time to reduce alpha drag.

Your first early investment, in a diversified portfolio of risk, offers sensible non-correlated returns, but the true secret to outsized returns comes from the option to over-allocate in the later state as market arbitrage is revealed.

That option reveals itself first in the private growth phase. But may reveal itself again post IPO. The early private investor maximizes optionality because they have information and time to diversify or over-allocate while the broader market is still gathering information.

Black–Scholes is really a proxy for information arbitrage. While a 2015 Amazon investor did better than a 2000 investor from a Time Value of Money perspective, no one knew ex-ante if the information arbitrage in Amazon would reveal in 2000, 2010, or 2020. Is risk volatility in the asset or missing the optionality?

A 1995 Amazon investor's total return was a bit higher than a 2000 investor, but at a better ex-ante beta. The investor that invested in Amazon’s Series A, and then disproportionately invested in the Series C (Leveraging info arbitrage), likely beat everyone on an alpha, beta, and TVM basis.

The Amazon story is even more interesting if you read every one of Jeff Bezo’s annual letters. He telegraphed the future opportunity long in advance. The information arbitrage was in plain sight but overlooked by many. Or ignored until performance met opportunity.

Diversification is a good strategy if you do not have information arbitrage. But, is asymmetric allocation better if you do have access to an information arbitrage.

An allocator with long history of investing in the secular economy, that is also invested in wide portfolio of early-stage investing, likely gains maximum information arbitrage. Because they are gathering information, even if imperfect, from the old and new economy. They could maximize returns if they differentially invest as optionality matures, but before information diffusion. To do so they probably need to be long old economy and allocated to a broad portfolio of early-stage investment. If so, they should evaluate their capital allocation decision not on the returns of the early stage portfolio, but the combined risk reduction from the imperfect information gathered across the portfolio and the time it takes for imperfect information to diffuse in the marketplace. In the case of Amazon, this took 20 years. In the case of how biology and data change food and health, we are in the first quartile of diffusion. Perhaps the first decile.

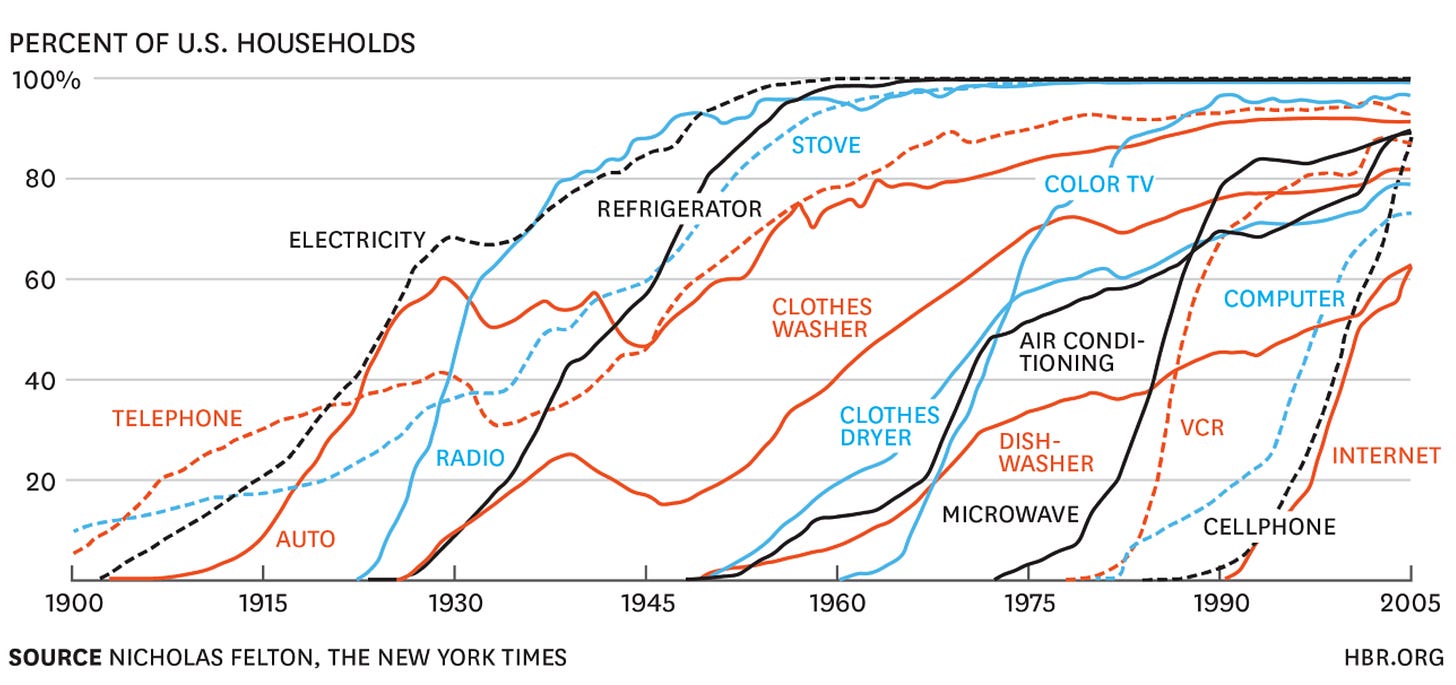

Every major market shift exhibits the same pattern. It underperforms forecasts in the near term. It exponentially exceeds forecast in the long term. Ray Kurzweil outlines this dynamic in his essay: The Law of Accelerating Returns. If you geek out on this problem and do some system dynamics modeling you will learn ultimately the rate of change is a function of information diffusion and industry structure. Knowledge of the old economy exposes industry structure. Knowledge from venture investing exposes the levers and rates of diffusion.

But how do we practically find and apply information arbitrage?

Who understood information arbitrage and diffusion better than Hambrecht & Quist? In the mid 90's when banks ran away from Silicon Valley, H&Q doubled down. Dan Case exposed the information arbitrage to a few. Those few investors saw outsized returns. H&Q exposed technology that is now obvious.

It took decades to see what H&Q saw. Were they prescient? Or perhaps did their presence in the middle of startup stew expose so much information they could not help but to have a natural arbitrage? Never lead left, but involved in every IPO.

What did H&Q know?

“... I prefer true but imperfect knowledge, even if it leaves much undetermined and unpredictable, to a pretense of exact knowledge that is likely to be false.”

― Hayek. F. A.

In The Use of Knowledge in Society, Hayek told us long ago, the "Coordination Problem" is solved by the information revealed in the market. My observation is that investments in early-stage startups are the mechanism to reveal that knowledge while improving the "Signal to Noise" ratio over pundits or futurists. The Father of Information theory, Claude Shannon, put Hayek’s observations in practice in ways a few of us are just now begging to understand. Shannon and Hayek are the intellectual fathers of “Big Data”. Dan Case and H&Q were yet one imperfect form that beat the market.

If imperfect knowledge provides investment arbitrage that perfects capital allocation, and venture capital exposes information arbitrage and optionality, I wonder….

…..does anyone have the vision to translate Haeyk’s, Shannon’s and Case’s observations into a new investment framework? Perhaps a Network-centric Investing framework, that maximizes the arbitrage and opportunity to invest, with enough insight from “The Greeks” to properly invoke Black-Scholes and Time Value of Money.

Put another way, what do you get when you merge a conviction-focused evergreen venture fund, H&Q, and a network of 1000s of startups, investors, customers, and experts all in one comprehensive network of information and investing?

I don’t think it will be Sequoia. But they will try.