Six-Sigma in AgTech

You cannot improve a process if it is not ultimately under statistical control

Janette Barnard outlines 3 key investment criteria we should use in venture investing. And I think investors should use her points in their diligence to solve the misallocation of resources in AgTech and sustainability.

Read her post on substack. And if you invest in agtech, pay for her substack it is good.

I would add to the second point on her post, an obscure comment on noise that has vexed me. Perhaps it will vex you.

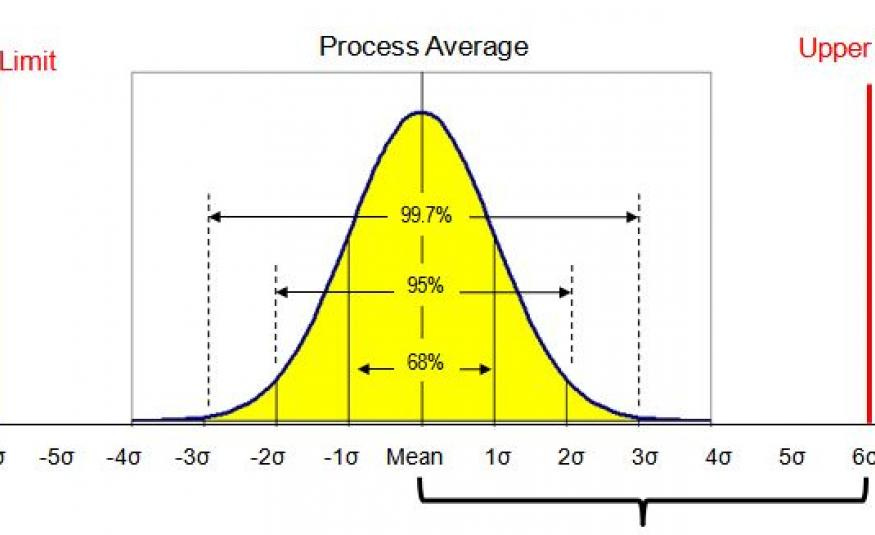

In manufacturing, we talk about the need for the tolerance band within 3 stdev of the mean. If so, the process is "Under Control". What that also means is that you can attribute data to cause. If the variance of the process outways the signal (i.e. true yield in agronomy), you can not. Therefore you really can not improve the process in a reliable manner. Six Sigma takes this further to say you need to be at +/- 6 stdev. For many reasons a Six Sigma black belt can explain. I was personally tutored for a week in St. Louis by Bill Smith in 1991 on this topic well before the world of black belts. Bill Smith created Six Sima.

My week with Bill Smith was an epigenetic transformation that affects me to this day. I sometimes feel like I am the only person that gets this (except the other 20M people in manufacturing that also get it). Bill's guidance led me to propose we measure virtually every part, in extreme detail, going through the McDonnell Douglas machine shop on the F/A-18. Then use that data to redesign our manufacturing processes and design on the F/A-18 E/F program. The net effect was a 1B savings on the first 10 aircraft. And Billions more across production and the C17. We took all that detailed part data and for the first time, had the mean, standard deviation, skewness and kurtosis. We modeled that using a monte-carlo (A tool called VFA) on the CAD Wireframe using IGES exports (this was before parametric CAD). We ran these monte-carlo models for days on HP 720 workstations in an early form of distributed compute not unlike the current AWS elastic infrastructure. We used the results to pick different designs, tooling, materials, assembly sequences etc. The next effect was dramatic.

I like system variance and six sigma control as an investment filter. And as a goal. In many ways, I would like vence corp, EarthOptics, CamoAg, Sentera and Arable (and even Benson Hill) to optimize the variance. Frankly, I would like all the crop input companies to minimize the variance. And all the measurement/data companies to observe the variance and their correlation. I would take this to the next step and monitor nutrition variance in products, tying it back to the dirt, and understanding each element of variance in between. It is complex, but so is the F/A-18 with more than 32,000 designed parts and many more things like fasteners. The aircraft system is optimized for quality but also flight characteristics. The dimples from rivets actually help draw the boundary layer closer and reduce drag, but also can impact radar image. Everything in aircraft design is a complex tradeoff of cost and mission.

At iSelect Fund we note that the US spends $1.9T annually, and the globe more than $11T, on the healthcare cost of poor nutrition. The nerd in me says we should break down the $1.9T elements and link them to ventures. Interpret which ventures illuminate the cost elements or deliver better, cheaper solutions. Then systematically turn the $1.9T into 1.5, 1.2, 0.5, and finally 0. Using data from the system to reduce variance and in a sense, make these processes #sixsigma. Once they are Six Sigma, you can use the localized observation to root cause, correct, and innovate. Each innovation improves productivity and lowers costs. Venture capital is applied at the key lever points that narrow variance.

Does any understand what the hell I am talking about or are aliens in my head making me see ghosts?

#investwithimpact

Great article. Having worked in two different organizations in my career, one aligned with TPS and the other Six-Sigma, it was interesting the difference IMO. The great irony was the scientific corporation was TPS driven, system thinking, etc while the food adjacent business was six-sigma. Both approaches work in quite different ways. Maybe not fair but to me six-sigma more top down mathematically rooted and very data driven while TPS captures knowledge of the doers bottom up. I believe , for example individual farmers who understand the specifics of their region, their suppliers, their soil will have long-term better success in transforming their situation by working cooperatively. Hope this makes sense?