What I learned this Week: November 2, 2025

From Nuclear Command to Biological Code: How Systems Hold or Fail Under Stress.

Lessons of the Week

I watched A House of Dynamite on Netflix, and it bugged me. The producers seem intent on scaring viewers into thinking we don’t really understand our nuclear systems or how we’d respond under threat. The U.S. has a deep, well-tested understanding of detection, attribution, and command-and-control. We have war-gamed all sorts of scenarios for decades. We and our allies have multiple launch detection systems. The scenario movie builds on, a single, ambiguous missile triggering chaos, is highly improbable. The joint odds that an adversary blinds our “moated” Command and Control, slips a single NK-class ICBM through, and gains strategic advantage are vanishingly small. Cyber at scale against air-gapped, multi-path, human-in-the-loop systems is a single-digit-percent event at best; a lone long-range warhead reliably delivering, surviving re-entry, and detonating on target is, generously, a coin flip. Meanwhile, our second-strike posture (triad + distributed Command and Control) is built to ride out first hits from hundreds of missiles. A rational adversary needs certainty; the probability stack doesn’t give it to them. And the US is not going to launch multiple nuclear weapons in response based on a hunch.

What I learned this week….

Wall Street has moved to Miami, and family offices have moved to Palm Beach. This shift, while fostering new opportunities, also dismantles the historical social linkages and informal accountability networks that once characterized the industry in New York.

To advance value-added agriculture, we need non-destructive sensor technology to capture the architecture of crop roots.

35% of Zepbound sales are via Lilly Direct. 40% of people with diabetes are undiagnosed. 80% of chronic patients do not receive standard of care. What stops high blood pressure, diabetes, and high cholesterol first-line treatment via direct technology?

Health costs are not a policy issue; they’re a design flaw in our economic system. Policy can not fix the system. Food can.

It’s possible to infer the body’s call for an inflammation response via EEG. With advances in AI signal processing, HRV, and other autonomic signals, this could provide a longitudinal inflammatory assay. CGM and digital inflammatry assay would be a game changer in chronic disease.

Chronic disease isn’t random; it’s an information problem (i.e. hormones). Biology’s feedback loops have been corrupted by industrial food signals. Restore the signal-to-noise ratio, and health self-organizes.

Edacious, Brightseed, Bonumose, Holobiome, and Miraterra are mapping the nutritional genome of food systems, creating the data layer to price health outcomes.

Independent grocery data showing a 5% decline in center store sales but an overall profit increase suggests consumers are moving toward real food. Some consumers seem to know what is good for them.

“Never doubt that a small group of thoughtful citizens can change the world. Indeed, it’s the only thing that ever has.” -- Margaret Mead

AI Updates

→ AI Slashes Drug Discovery Costs 17-Fold: MIT researchers and biotech startup Cellarity just published results for DrugReflector, an AI model that finds promising drug compounds up to 17 times more efficiently than traditional high-throughput screening. This matters because Big Pharma has spent forty years building a $2.3 billion-per-drug business model around billion-dollar robotics facilities that randomly screen tens of thousands of compounds. Now a deep-learning system trained on public genomic data does the same work seventeen times faster at a fraction of the cost. Expect resistance playbook: FDA lobbying, “safety” regulations designed to favor incumbents. Winners: Recursion Pharmaceuticals (NASDAQ: RXRX), Cellarity, Insilico Medicine, and Atomwise: AI-native companies with no legacy infrastructure. Losers: Pfizer, Merck, Roche, GSK collectively spending $200+ billion on legacy HTS facilities through 2030. Incumbents will write down infrastructure investments and rebuild around AI, or watch startups deliver better candidates faster.

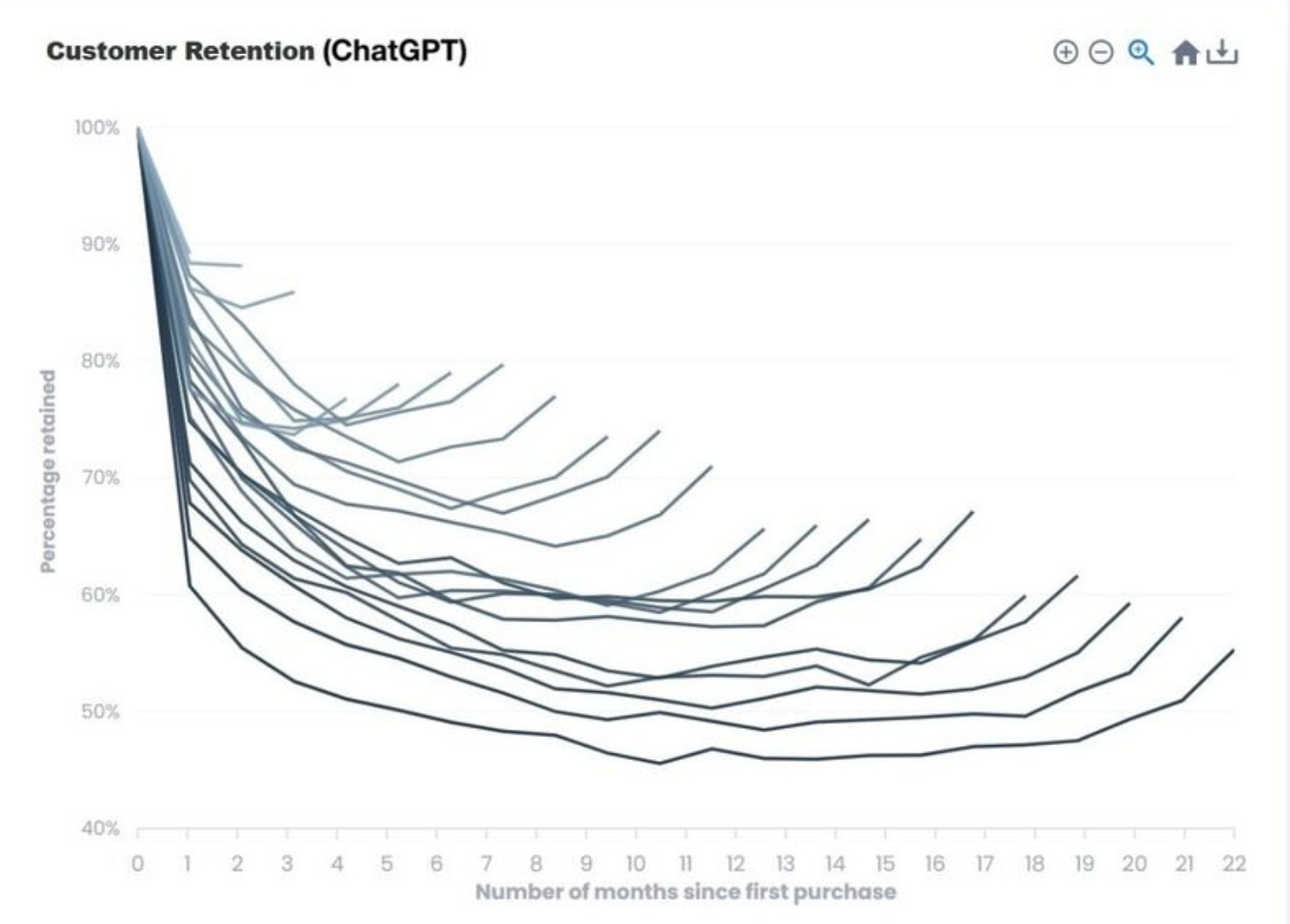

→ OpenAI Retention Curve: This retention curve is what disruption looks like in data. Each line represents a cohort of ChatGPT users over time. Normally, retention curves fall off fast. People try, leave, and only a few stick. Here, the opposite is happening. The curves dip, then rise. That means usage deepens the longer people use it. It’s the signature of a compounding platform: users integrate it into their workflow, build around it, and create lock-in for themselves.

Technically, that means ChatGPT has crossed the behavioral Rubicon. If so, ChatGPT is not an app; it’s an infrastructure layer. Once retention compounds, the marginal cost of serving new behavior drops, while the marginal utility for users rises. That’s when industries get rewritten.

For incumbents, this curve is a warning label. To be disrupted, three things must be true:

The new tool becomes cheaper and more convenient at the edge

Users learn faster than firms can adapt

New ecosystems start forming on top of it faster than old ones can regulate it

This chart says all three are already in motion. What started as a chatbot is now becoming the new operating system for knowledge work, and every curve still bending upward is another nail in the old model’s coffin.

→ Chat Bot Romance: Nearly one in five U.S. high school students has had a romantic relationship with an AI, or knows someone who has, according to a 2025 national survey. The same research found 42% of students have used AI for companionship. One of the largest AI NSFW chatbot companies reports they had “millions of users” in the United States. This stuff is far, far more popular than many realize.

→ Workslop: AI-generated work content that appears polished but lacks substance to meaningfully advance a task, shifting the burden of work downstream to colleagues who must interpret, correct, or redo it. According to BetterUp Labs research, 40% of employees receive workslop monthly, spending an average of two hours addressing each incident.

Economics

→ Recommerce Programs Expand as Product Durability Improves: Leatherman launched its Exchange program this week, a peer-to-peer marketplace where owners trade in used multi-tools for store credit. The move exposes why customers actually want used tools. The first customer type is a rational calculator. Leatherman tools last 25 years, so a five-year-old Wave at 60% off is not a discount, it is a durable good with decades remaining. Trove data shows second-hand shoppers have cart sizes 2X larger than primary purchasers, with 50-65% new to the brand. They come for economics. The second customer is driven by legacy and attachment. A Leatherman owner trading in a 12-year-old tool is not replacing failure, they are upgrading a working companion. Patagonia’s Worn Wear program taps into this precisely. Customers buying pre-worn jackets inherit a story, the patches, the weathering, proof of real use.

This pattern scales across durable categories. High-end kitchen knives, Dyson vacuums, Arc’teryx gear, and vintage Carhartt workwear all follow the same logic. As engineering improves and products last longer, recommerce becomes less about liquidating failures and more about capturing the upgrade cycle. A 10-year-old Dyson is not obsolete. A climbing harness from 2015 is still load-rated. These products create dual customer bases: price-driven upgraders and legacy-driven collectors who find meaning in products that simply refuse to fail.

The global recommerce market was valued at 188.1 billion in 2024 and is projected to reach 210.7 billion in 2025. By 2029, the global market is forecast to reach 310.5 billion, growing at 10.2% annually, with some projections reaching 2,087 billion by 2035.

Charts and Social

→ Chat GPT takes on management Consulting: Management Consulting-as-a-Service is a form of price discovery that lasts only as long as it takes corporations to learn ChatGPT for themselves. Early signs are that McKinsey and other consulting firms are losing share to Palantir and other AI first consultancies. If given the choice of 1) Hire McKinsey, 2) use Chat GPT, or 3) Hire Palntir, what will corporations do?

→ Oral Pathway for Cancer Testing: The mouth is emerging as one of the most overlooked diagnostic frontiers in medicine. Studies now link specific oral bacteria, such as Porphyromonas gingivalis, to Alzheimer’s disease, cardiovascular disease, and diabetes. Companies such as Bristle Health, OralDNA Labs, and Cmbio are already sequencing saliva to identify microbial shifts that correlate with neurodegeneration and systemic inflammation, effectively turning the mouth into a “liquid biopsy” for the body. Recent research in Nature (2025) and Alzheimer’s & Dementia journals confirms that oral-microbiome diversity patterns can predict disease risk years before symptoms appear, suggesting the potential for early, noninvasive screening tools that are cheaper and more scalable than imaging or blood panels. For investors, this represents a new intersection of genomics, AI diagnostics, and preventive health, where every toothbrush, mouthwash, or dental visit could become part of a real-time health-monitoring network.

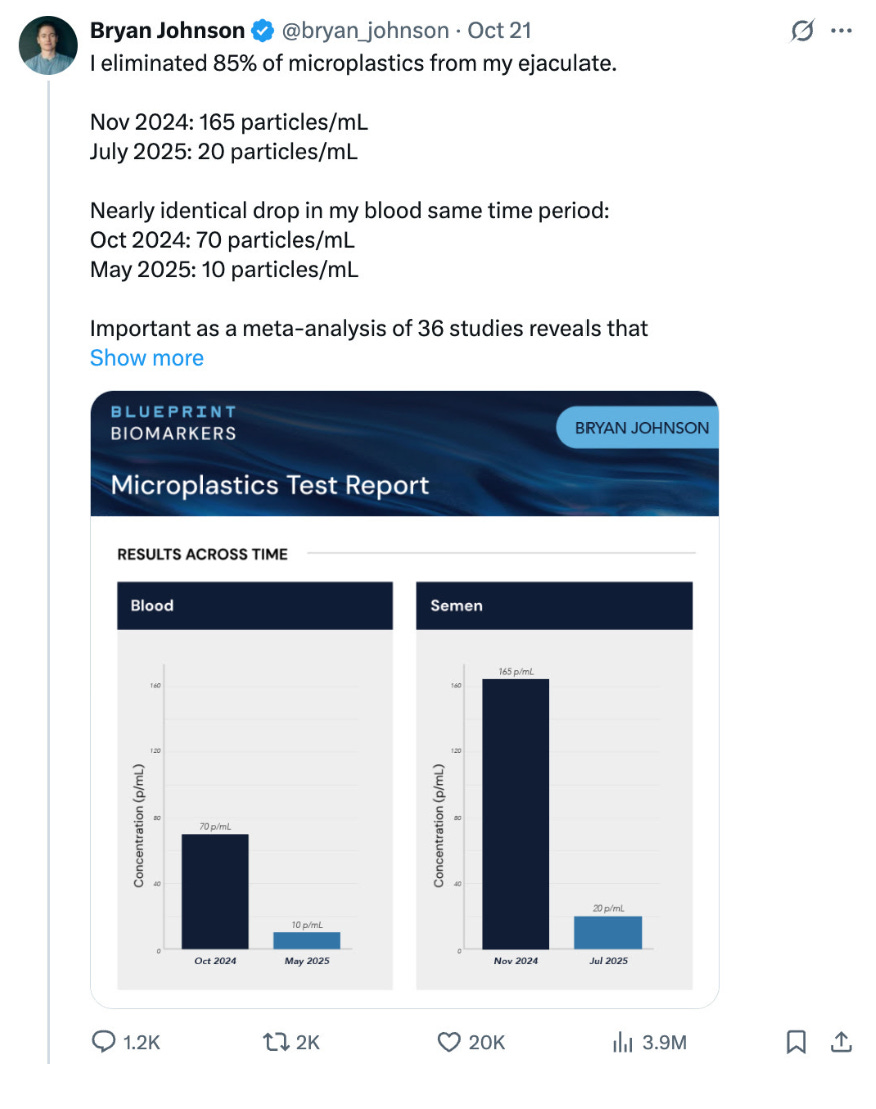

→ Microplastics: In Case you were wondering about microplastics, you can reduce them.

The DrugReflector findings highlight the innovator's dilemma facing companies like Merck with massive legacy infrastructure investments. A 17x efficiency gain is not incremental improvement, it's a complete disruption of the business model. The regulatory lobbying you mention is inevitable, but history shows that incumbents who try to regulate away competiton rather than adapt usually lose. Merck's choice is clear: write down the HTS facilities now and pivot to AI-first drug discovery, or watch their R&D productivity gap widen while startups move faster and cheaper.